Calculator DC Rate Punjab 2026 (Pakistan): Latest Property & Land Valuation Guide

Punjab DC Rate & Stamp Duty Calculator 2026

Official calculator for Punjab, Pakistan | Updated with 2026 government rates for CVT, Stamp Duty & Registration

📋 Property Information

📖 How to Use This Calculator

- Select your district: Choose the district where your property is located

- Choose location type: Urban areas have different rates than rural areas

- Property type: Select residential or commercial property

- Enter size: Input the property size in your preferred unit (Marla, Kanal, Sq ft, Sq yd)

- Calculate: Click “Calculate Taxes” to get instant results

- Urban Areas: Stamp Duty = 3% of DC value, CVT = 2% of DC value (Total: 5%)

- Rural Areas: Stamp Duty = 3% of DC value, CVT = 0% (Exempt from CVT)

- Registration Fee: ₨500 (if value ≤ ₨5 lac) or ₨1,000 (if value > ₨5 lac)

- Conversion Rates: 1 Kanal = 20 Marla | 1 Marla = 272.25 Sq ft | 1 Marla = 30.25 Sq yd

🔧 How to Update DC Rates (For Administrators)

The DC rates in this calculator are sample values. To update with official rates:

- Visit the Punjab e-Stamp portal or Punjab Land Records Authority (PLRA) website

- Navigate to the DC Valuation section for your district

- Copy the official DC rates (usually provided per Marla for different property sizes and types)

- Update the

dcRatesobject in the JavaScript code at the bottom of this HTML file - The rates are organized by district → property type → size bands

🔗 Official Government Sources

- Punjab e-Stamp: Property DC Valuation Portal

- Board of Revenue Punjab – Official Website

- Punjab Excise & Taxation Department

- Punjab Land Records Authority (PLRA)

Disclaimer: This calculator provides estimates based on the DC rates entered. Always verify with official sources before making property transactions. Rates are subject to change by government notification.

When dealing with property transactions in Punjab, understanding the dc rate Punjab is essential. This rate plays a crucial role in determining the value of immovable properties, impacting taxes, stamp duties, and overall property valuation. In this article, we will explore what the dc rate is, how it is applied in Punjab, and its significance in the real estate market. The DC rate system is part of the property valuation framework used in Pakistan, and Punjab is one of the regions where it is applied.

What is DC Rate Punjab?

The dc rate Punjab refers to the official valuation rate set by the District Collector (DC) office in Punjab, Pakistan. It is a government-determined rate used to assess the value of properties for taxation and legal purposes. The dc rate is a critical component in the property dc valuation process, ensuring that property transactions are conducted transparently and fairly.

This rate helps the government calculate the capital value tax, stamp duty, and other fees associated with property dealings. The dc rate per marla or per unit area varies depending on the location, phase, and type of property, such as residential or commercial.

How DC Valuation Works in Punjab

The dc valuation in Punjab is conducted by the revenue circle under the supervision of the District Collector. The DC office determines the dc value based on various factors, including the property’s location, market trends, and area. This valuation is essential for the valuation of property and serves as a reference point for the valuation rates applied to property transactions.

To calculate the property dc valuation, the DC office considers the property area and applies the dc rate per marla or square foot, depending on the measurement system used. For example, DC rates can differ significantly in specific areas such as phase 3 of major housing societies, where phase 3 is often highlighted in property valuation discussions due to its distinct rates for both residential and commercial properties. This valuation is then used to compute the applicable taxes and stamp duties, ensuring compliance with the government’s regulations.

Importance of DC Rate in Property Transactions

The dc rate is vital for several reasons. Firstly, it provides a standardized method to assess the value of a property in Punjab, which helps prevent undervaluation or overvaluation in real estate deals. Secondly, it ensures that the government collects the appropriate amount of stamp duty and capital value tax, which are crucial for public revenue.

Moreover, the dc rate is used in conjunction with other rates, such as the FBR valuation or FBR rate, set by the Federal Board of Revenue. Understanding the difference between the dc rate and the FBR rate is important for buyers and sellers to ensure accurate tax payments.

How to Calculate the Property DC Valuation

To calculate the property dc valuation, you need to multiply the property area by the dc rate per marla or square foot, depending on the local standards. For example, if the dc rate per marla in a particular area of Punjab is set at a certain amount, and your property size is known, the calculation becomes straightforward.

This calculation helps you determine the property valuation rates applicable to your property, which in turn affects the amount of stamp duty and other charges payable to the government. The e stamp system in Punjab facilitates the payment and recording of these duties, making the process more transparent.

DC Rates and Market Value in Punjab

It is important to note that the dc rates may not always reflect the current market value of properties in Punjab. The government sets these rates based on periodic assessments, which might lag behind real estate market fluctuations. Therefore, the dc rate is often lower than the actual market price, which can lead to discrepancies in property valuation.

Understanding this difference is crucial for buyers and sellers to avoid disputes and ensure that all transactions comply with legal requirements. The dc rate serves as a baseline for taxation, while the market value is determined by supply and demand dynamics.

e-Stamping Procedure in Property Transactions

The e-stamping procedure is a modern, digital solution for handling property transactions in Punjab. This system is designed to streamline the process of paying stamp duty and capital value tax, both of which are calculated using the dc rate per marla or per unit area. When you initiate a property transaction, the e-stamp system allows you to enter details such as the property type, area, and location online. Based on this information, the system uses the official dc rate to calculate the exact amount of stamp duty and capital value tax you need to pay.

Once the details are submitted, the e-stamp portal generates a unique e-stamp certificate, which serves as legal proof of payment. This digital approach not only makes it easier to calculate and pay the required taxes but also reduces the chances of errors and fraud in property transactions. The e-stamp system is now widely used in Punjab for all types of properties, ensuring that the process is transparent and efficient for both buyers and sellers. By using the e-stamp system, you can be confident that your property transaction complies with the latest government regulations and that the correct dc rate per marla has been applied to your property valuation.

FBR Valuation and Taxation in Punjab Real Estate

In Punjab’s real estate sector, the Federal Board of Revenue (FBR) valuation system plays a key role in determining the tax obligations on property transactions. Unlike the dc valuation, which is primarily used to calculate stamp duty and capital value tax, the FBR valuation rates are used to assess capital gain tax and withholding tax when properties are sold or transferred. These FBR valuation rates are often higher than the dc rates, reflecting a different approach to property valuation in Punjab.

The FBR valuation system is used alongside the dc rates to ensure that all property transactions are taxed fairly and transparently. When you engage in a property transaction, both the dc valuation and FBR valuation may be considered to calculate the total tax liability, including capital value tax and stamp duty. This dual system helps the government generate revenue while maintaining oversight of the real estate market. Understanding how the FBR valuation works, and how it differs from the dc valuation, is essential for anyone involved in property transactions in Punjab, as it directly affects the amount of tax you will need to pay.

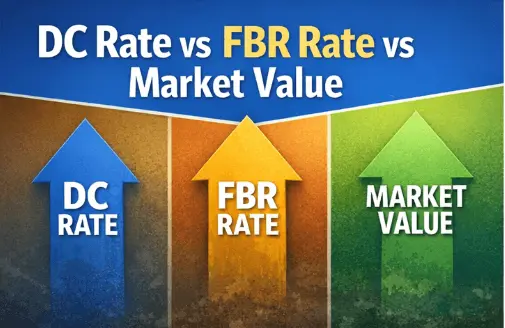

Difference Between Valuation Methods: DC Rate vs. FBR vs. Market Value

When it comes to property transactions in Punjab, understanding the difference between the dc rate, FBR valuation, and market value is crucial. The dc rate is set by the government and is used to calculate stamp duty and capital value tax on property transactions. The FBR valuation, on the other hand, is used to determine capital gain tax and withholding tax, and is generally higher than the dc rate. Both the dc rate and FBR valuation are official rates used to calculate the tax liability for property is being sold or transferred.

The market value, however, is the actual price at which a property is bought or sold in the open market. This value is often higher than both the dc rate and FBR valuation, as it reflects current demand and supply conditions. The difference between these valuation methods can significantly impact the taxes you pay and the overall cost of property transactions. Knowing how to calculate the applicable taxes using each rate ensures that you comply with legal requirements and avoid unexpected tax liabilities. For buyers and sellers, understanding these differences is key to making informed decisions in the real estate market.

Role of Government in Property Valuation

The government has a central role in property valuation in Punjab, setting the dc rates and FBR valuation rates that form the basis for calculating taxes on property transactions. Through the District Collector’s office, the government establishes the dc rates used for property valuation, stamp duty, and capital value tax. The FBR, meanwhile, sets the valuation rates used for capital gain tax and withholding tax. The government also oversees the e-stamping procedure, ensuring that the process of paying stamp duty and capital value tax is transparent and secure.

By regulating these valuation rates and procedures, the government helps maintain fairness and transparency in the real estate sector. The tax revenue generated from property transactions is used to fund essential public services and infrastructure projects, benefiting the wider community. The government’s policies on property valuation can influence the demand for properties, the rates of property transactions, and the overall health of the real estate market in Punjab. For anyone involved in buying or selling property, understanding the government’s role in setting and regulating valuation rates is essential for navigating the legal and financial aspects of property transactions.

Conclusion

In summary, the dc rate Punjab is a fundamental element in the valuation of property and real estate transactions in Punjab. It is a government-set rate used by the District Collector’s office to determine the official value of immovable properties. Knowing how to calculate the property dc valuation using the dc rate per marla helps property owners, buyers, and sellers understand their tax liabilities and comply with legal obligations.

Whether you are dealing with property valuation rates or capital value tax, understanding the dc rate and its application in Punjab’s real estate market is essential. Always ensure that your property transactions are aligned with the dc valuation in Punjab to avoid any legal or financial issues.