Tax on Sale Purchase of Property in Pakistan: 2026 Updated Guide

The Pakistani real estate sector contributes significantly to the country’s GDP, making property transactions a substantial source of government revenue through various taxes. Property-related tax in Pakistan includes several types of taxes and legal obligations for property owners, sellers, and real estate buyers. Whether you’re buying, selling, or inheriting property in Pakistan, understanding the tax implications is crucial for making informed financial decisions.

This comprehensive guide covers all aspects of property taxation in Pakistan, including the latest updates for 2024-25 and 2025-26, helping you navigate the complex landscape of real estate taxes with confidence. Understanding these taxes is especially important for real estate buyers and sellers in Pakistan.

Quick Overview: Property Taxes on Sale purchase in Pakistan 2025-2026

Property transactions in Pakistan are subject to multiple taxes that vary based on your filing status, holding period, and property type. Different tax percentages apply depending on the type of transaction and taxpayer status. Here’s what you need to know:

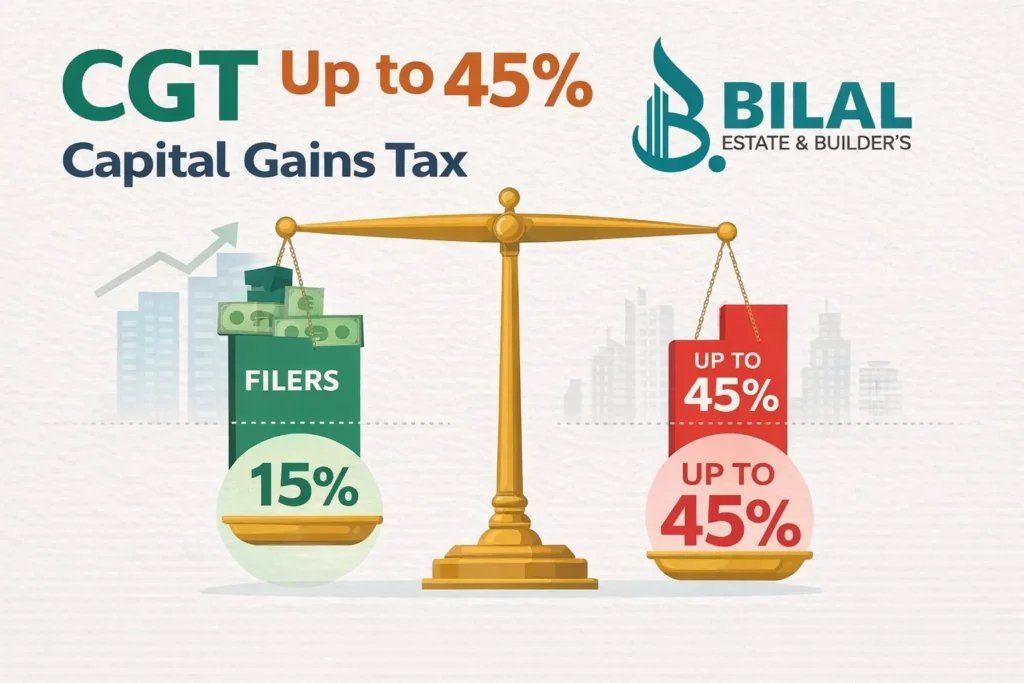

- Capital Gains Tax (CGT): 15% for filers, 15%-45% for non-filers (tax applies when selling property, based on holding period and filer status)

- Advance Tax: Ranges from 1.5% to 5.5% depending on property value (tax applies at the time of property purchase or sale, depending on the transaction)

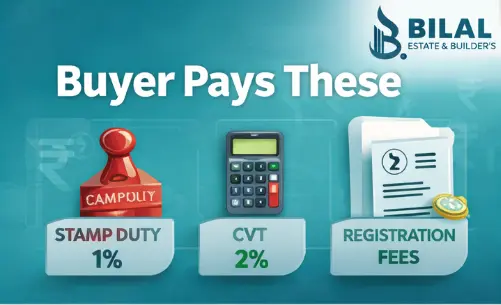

- Capital Value Tax (CVT): 2% of property value (tax applies at the time of property transfer)

- Stamp Duty: 1% of property value for registration (tax applies at the time of property registration)

- Registration Fees: Additional provincial charges apply (tax applies during the registration process)

Understanding Property Tax Categories

1. Capital Gains Tax (CGT)

Capital Gains Tax is levied on the profit earned from selling property. This tax is commonly referred to as Capital Gain Tax (CGT), and in Pakistan, it is also known as gain tax. The rates have been significantly revised in the 2024-25 budget to encourage tax compliance and documentation of the economy.

Current CGT Rates (2025-26):

For Active Tax Filers:

- Flat rate of 15% on net capital gains regardless of holding period

- Applies to all property sales after July 1, 2024

For Non-Filers and Late Filers:

- Progressive rates ranging from 15% to 45% based on property value

- Higher rates imposed to encourage tax filing compliance

- Exact rates determined by FBR valuation tables

How CGT is Calculated: Capital Gain = Sale Price – (Purchase Price + Improvement Costs + Transaction Costs). Individuals are required to pay capital gains tax when they sell property and make a profit, and must pay CGT according to the applicable rates and procedures set by the FBR.

2. Advance Tax on Property Transactions

Advance tax is deducted at the time of property registration and varies based on the gross consideration or fair market value of the property. Advance property tax, also referred to as advance income tax, is a withholding or prepaid tax collected during property transactions in Pakistan.

Tax Rates for Property Purchase:

- Active Filers: 1.5% – 3% (reduced rates as incentive)

- Non-Filers: 3% – 5.5% (higher rates to encourage filing)

Tax Rates for Property Sale:

- Active Filers: 4.5% – 7.5%

- Non-Filers: 7.5% – 15%

These rates are applied based on property value brackets determined by the Federal Board of Revenue (FBR).

3. Capital Value Tax (CVT)

CVT is a one-time tax paid by the buyer at the time of property registration. CVT is applicable to both residential and commercial property transactions in Pakistan. For 2025-26, the rate is set at 2% of the property’s declared value as per the purchase agreement, following the Federal Act 2006.

4. Withholding Tax (Section 236C)

This tax is collected at source during property transactions and can later be adjusted against your annual tax liability when filing returns. Withholding taxes can significantly impact the real estate market in Pakistan, as higher withholding taxes may reduce demand, discourage investment by non-filers or late filers, and potentially lead to lower property prices.

5. Deemed Rental Income Tax

Deemed Rental Income Tax is a significant component of property taxation in Pakistan, particularly for owners of immovable properties that are not actively rented out. Under current tax laws, the government assumes that every property generates a certain amount of rental income, regardless of whether the property is actually leased. This notional or “deemed” rental income is calculated based on the property’s fair market value, ensuring that property owners contribute to government revenue even if their property remains vacant or is used for personal purposes.

For the 2025 tax year, deemed rental income tax is typically levied at a rate of 1% of the fair market value of the immovable property. The fair market value is determined using official valuation tables or professional assessments, and this value forms the basis for calculating the tax owed. This approach aims to broaden the tax net and reduce tax evasion in the real estate sector.

Property owners should be aware that deemed rental income tax can significantly increase their overall tax burden, especially for high-value properties or those held as investments. Compliance with these tax laws is essential to avoid penalties and ensure smooth property ownership. It is important for property owners to stay updated on the latest regulations regarding deemed rental income tax, as changes in tax rates or valuation methods can directly impact their annual tax liability. Consulting with tax professionals can help property owners understand their obligations and minimize their rental income tax exposure.

Tax on Sale purchase of Property in Pakistan by Holding Period

While the current system primarily uses a flat 15% rate for filers, holding period considerations may still apply in certain circumstances. The applicable tax rates also depend on the taxpayer status of the seller, as FBR regulations differentiate between filers and non-filers:

Short-term Holdings (Less than 1 year):

- Subject to higher scrutiny

- Full CGT rates apply without any exemptions

Medium-term Holdings (1-3 years):

- Standard CGT rates apply

- No significant rate reductions

Long-term Holdings (3+ years):

- Same rate structure but may qualify for certain exemptions

- Inflation indexation benefits may apply in specific cases

Tax on Inherited Property in Pakistan

Inherited property receives special treatment under Pakistani tax law:

Key Points for Inherited Property:

- No immediate tax liability upon inheritance

- Step-up basis applies – the property’s cost basis becomes the property’s fair market value at the time of inheritance

- CGT applies only on gains made after the inheritance date

- Documentation required: Succession certificate or inheritance documents

When Selling Inherited Property:

- Calculate gains from the date of inheritance, not original purchase

- Same CGT rates apply (15% for filers, 15%-45% for non-filers)

- Proper documentation essential to establish inheritance date

Provincial Variations in Property Tax

Property taxes can vary across Pakistan’s provinces, with each having specific regulations: Provincial governments are responsible for collecting and regulating property taxes, and the provincial government of each province sets the applicable tax rates.

Punjab Property Tax

- Filers: 15% capital gains tax rate

- Non-filers: Up to 45% tax rate

- Additional provincial charges may apply

In addition, the Punjab government levies an urban immovable property tax (UIPT) on properties located within city areas.

Sindh Property Tax

- Follows federal tax structure

- Additional stamp duty and registration fees

- Provincial property tax on annual basis

Tax rates and exemptions may differ for residential properties compared to commercial properties in Sindh.

Khyber Pakhtunkhwa (KPK)

- Provincial property tax system in place

- Registration and mutation fees vary

- Special economic zone considerations

Commercial properties in KPK may be subject to different tax rates and regulations compared to residential properties.

Balochistan

- Provincial variations in registration fees

- Federal tax structure applies for CGT

- Local government taxes may apply

In Balochistan, property tax is often calculated based on the residential property worth as determined by DC rates or official valuation tables.

Tax Changes: 2019-2025 Evolution

The property tax landscape in Pakistan has undergone significant changes:

2019-2020:

- Lower CGT rates with holding period benefits

- More complex rate structure based on years held

2021-2022:

- Introduction of stricter documentation requirements

- Enhanced penalties for non-filers

2023-2024:

- Gradual increase in tax rates for non-filers

- Improved incentives for active tax filers

2024-2025 (Current):

- Simplified flat rate structure for filers (15%)

- Significant rate increases for non-filers (up to 45%)

- Introduction of new property taxes and increased withholding taxes as part of the latest budget reforms

- Enhanced focus on economic documentation

Tax Calculation Examples

Example 1: Property Sale by Active Filer

- Purchase Price: PKR 10,000,000 (2020)

- Sale Price: PKR 15,000,000 (2024)

- Capital Gain: PKR 5,000,000

- CGT (15%): PKR 750,000

Example 2: Property Sale by Non-Filer

- Purchase Price: PKR 8,000,000 (2019)

- Sale Price: PKR 12,000,000 (2024)

- Capital Gain: PKR 4,000,000

- CGT (varies 15%-45%): PKR 600,000 – PKR 1,800,000

Example 3: Inherited Property Sale

- Inherited Value: PKR 12,000,000 (2022)

- Sale Price: PKR 14,000,000 (2024)

- Capital Gain: PKR 2,000,000

- CGT (15% for filer): PKR 300,000

Additional Costs and Fees

Beyond taxes, property transactions involve several other costs:

Registration and Documentation:

- Stamp duty: 1% of property value

- Registration fees: Varies by province

- Buyers are also required to pay taxes such as property registration tax and other related fees as part of the property registration process.

- Legal documentation costs

Professional Services:

- Property valuation fees

- Legal advisor charges

- Tax consultant fees

Government Charges:

- NOC fees (where applicable)

- Transfer fees

- Mutation charges

Non-Adjustable Property Taxes and Their Implications

Non-Adjustable Property Taxes are a crucial aspect of property transactions in Pakistan which is helpful for overseas pakistani to buy property in Pakistan that every property owner and investor should understand. Unlike adjustable property taxes, which can be offset against your final tax liability or refunded, non-adjustable property taxes are mandatory payments that cannot be reclaimed once paid. These include charges such as stamp duty, property registration fees, and other transactional levies imposed by provincial or local authorities.

The rates for non-adjustable property taxes typically range from 1% to 5% of the property’s value, depending on the type and location of the property. For example, stamp duty and registration fees are calculated as a percentage of the property’s declared or assessed value and are payable at the time of property transfer or registration. These costs are in addition to other property taxes in Pakistan and can significantly increase the total expense of buying or selling real estate.

For property owners and investors, it is essential to factor in non-adjustable property taxes when planning property investments or calculating the overall cost of property transactions. Failing to account for these taxes can lead to unexpected financial burdens and affect the profitability of property investments. Additionally, understanding the relevant tax regulations and laws is vital to ensure compliance and avoid any legal or financial penalties.

By being aware of non-adjustable property taxes and their implications, property owners can make more informed decisions, accurately estimate transaction costs, and better manage their property tax burden in Pakistan’s evolving real estate market.

Tax Compliance and Filing Requirements

For Property Sellers:

- File annual tax returns to maintain active status

- Declare property transactions in wealth statements

- Keep detailed records of all transaction costs

Property sellers must also ensure compliance with FBR property tax regulations when declaring property transactions.

For Property Buyers:

- Ensure seller’s tax compliance status

- Obtain proper tax clearance certificates

- Maintain purchase documentation

Property purchases in Pakistan involve specific tax implications and require proper documentation to ensure compliance.

Record Keeping Requirements:

- Purchase agreements and sale deeds

- Tax payment receipts

- Improvement and maintenance cost records

- Professional service invoices

Strategies for Tax Optimization

For Active Tax Filers:

- Maintain consistent filing to benefit from lower rates

- Document all improvement costs properly

- Consider timing of transactions for tax efficiency

For Property Investors:

- Plan holding periods strategically

- Maintain proper documentation

- Consider tax implications in investment decisions

General Recommendations:

- Consult qualified tax professionals

- Stay updated with annual budget changes

- Maintain compliance with filing deadlines

Impact of 2024-25 Budget on Property Market

The latest budget has introduced several changes affecting property taxation:

Positive Changes:

- Simplified rate structure for compliant taxpayers

- Clear incentives for tax filing

- Reduced complexity in calculations

Challenges:

- Higher rates for non-compliant taxpayers

- Increased documentation requirements

- Potential impact on property prices

- Introduction of Federal Excise Duty (FED) and federal excise duty on property booking, allotment, and transfer, with specific rates for residential and commercial properties. The taxation of deemed income, where a percentage of the property’s fair market value is treated as imputed income and taxed, has also significantly affected the real estate market.

Market Response:

- Increased focus on tax compliance

- Growing demand for professional tax advisory services

- Shift towards more documented transactions

Future Outlook: Property Tax Trends

Expected Developments:

- Further digitization of tax processes

- Enhanced integration with property registration systems

- Possible introduction of property-based withholding mechanisms

Policy Direction:

- Continued emphasis on documentation

- Gradual expansion of tax net

- Improved taxpayer services and compliance support

Industry Impact:

- Greater role of professional tax advisors

- Increased importance of compliance systems

- Evolution towards more transparent transactions

Common Mistakes to Avoid

Documentation Errors:

- Inadequate record keeping

- Missing transaction cost documentation

- Improper valuation certificates

Compliance Issues:

- Late or missed tax return filing

- Incorrect tax status assessment

- Failure to update taxpayer information

Planning Oversights:

- Ignoring tax implications in property decisions

- Inadequate professional consultation

- Poor timing of transactions

Frequently Asked Questions

Q: What happens if I sell property without filing tax returns?

Non-filers face significantly higher tax rates (up to 45%) and may encounter difficulties in future transactions. It’s advisable to become a tax filer before engaging in property transactions.

Q: Can advance tax paid during property transactions be adjusted?

Yes, advance tax paid under various sections can be adjusted against your final tax liability when filing annual returns, provided you meet the filing requirements.

Q: How is fair market value determined for tax purposes?

Fair market value is typically determined using FBR valuation tables, DC rates, or professional property valuations, whichever is higher for tax calculation purposes.

Q: Are there any exemptions available for property taxes?

Limited exemptions exist for specific circumstances, such as one-time exemptions for certain residential property categories or agricultural land, subject to meeting prescribed conditions.

Q: What documentation is required for inherited property transactions?

You’ll need succession certificates, inheritance documents, property valuation at the time of inheritance, and proper legal documentation establishing your ownership rights.

Conclusion

Property taxation in Pakistan has evolved significantly, with the current system emphasizing compliance and documentation. The 2024-25 budget reforms have created clear incentives for tax filing while imposing higher costs on non-compliant taxpayers.

Understanding these tax implications is essential for making informed property investment decisions. The key to successful property transactions lies in maintaining proper documentation, ensuring tax compliance, and seeking professional guidance when needed.

As Pakistan’s economy continues to develop, property tax policies will likely evolve further, making it crucial for property owners and investors to stay informed about changes and maintain compliance with current regulations.

Whether you’re buying your first home, selling an investment property, or dealing with inherited real estate, proper tax planning can save you significant amounts and ensure smooth transactions. Remember that tax laws are complex and subject to change, so consulting with qualified tax professionals is always recommended for your specific situation.

Disclaimer: This guide provides general information about property taxes in Pakistan based on current laws and regulations as of 2025 – 2026. Tax laws are subject to change, and individual circumstances may vary. Always consult with qualified tax professionals and legal advisors for advice specific to your situation.